Australian Tax File Number (TFN) is everyone's unique "tax identification number". According to Australian tax law, all people working in Australia must have their own tax number. When looking for a job or part-time job, employers will generally ask you to provide a tax number.

Is it okay if I don’t have a tax number?

If you do not have a tax number, whether you are interning at a company or working part-time, your income will be taxed at the rate of 45%, and the interest on bank deposits will also be taxed at 45%.

How to apply for an Australian TFN?

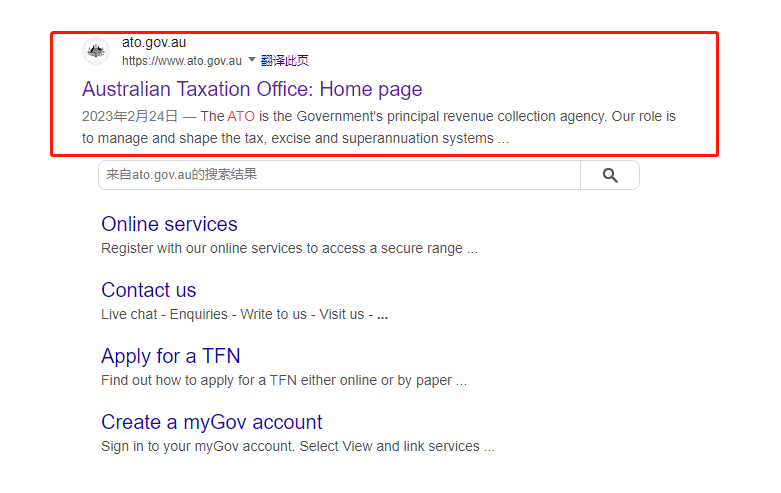

1. Find the ATO website for applying for a tax file number

Search ATO, select TAX file number

Or directly click on the official free application website link:https://www.ato.gov.au/individuals/tax-file-number/

Be careful not to choose the wrong website, as applications from other websites may require fees.

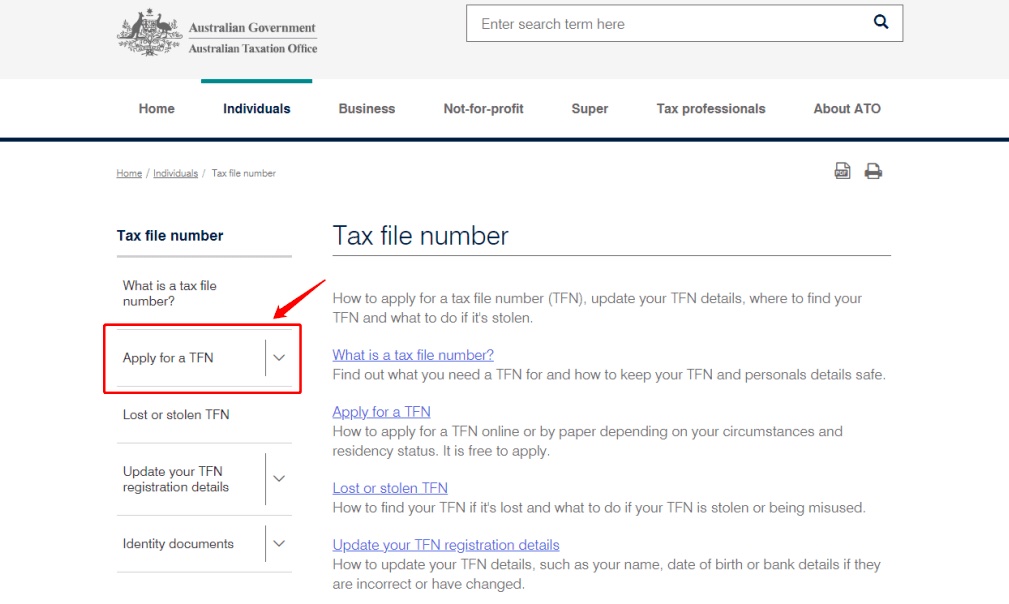

2. Start the operation after entering the page

After entering the page, select Apply for a TFN.

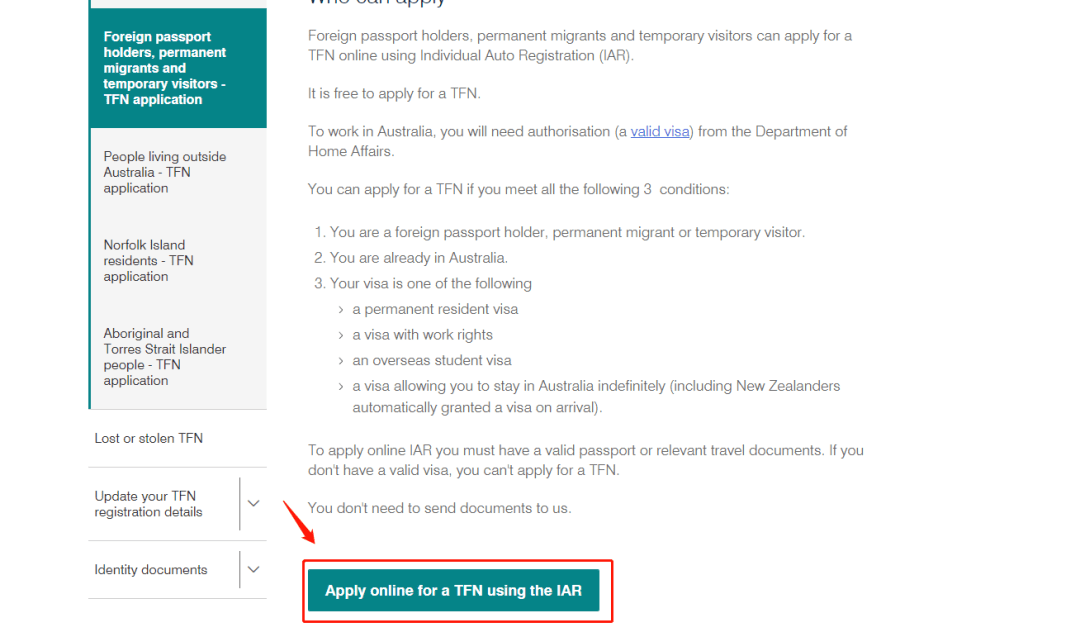

Select the Foreign passport holders option.

Jump to the page and select Apply online for a TFN from the drop-down menu.

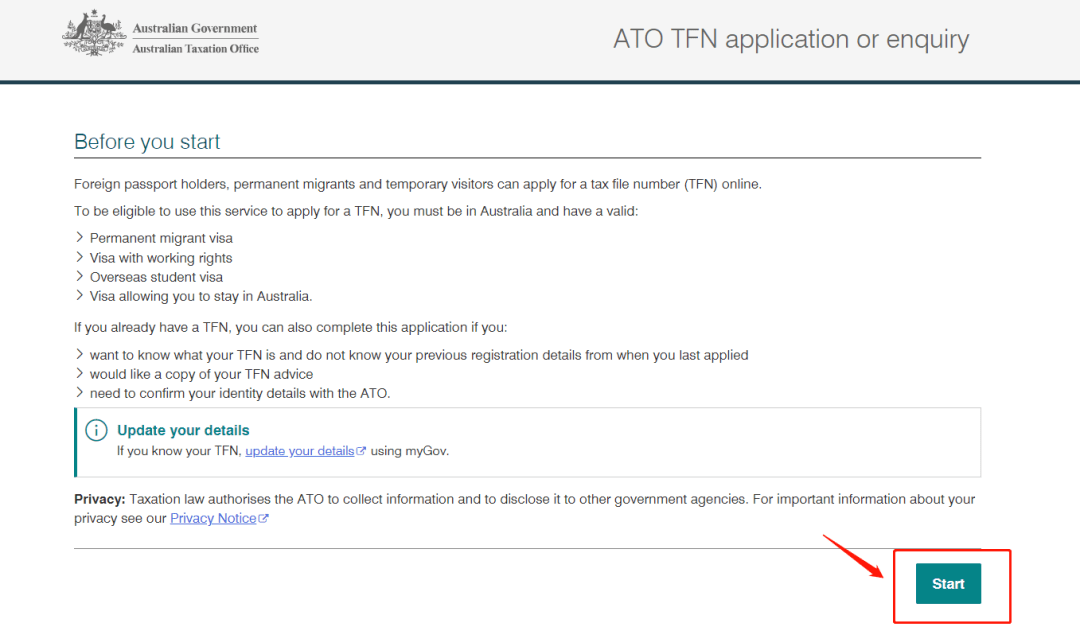

3. Fill in your personal information

After understanding the pre-application information, click Star to start filling in your personal information.

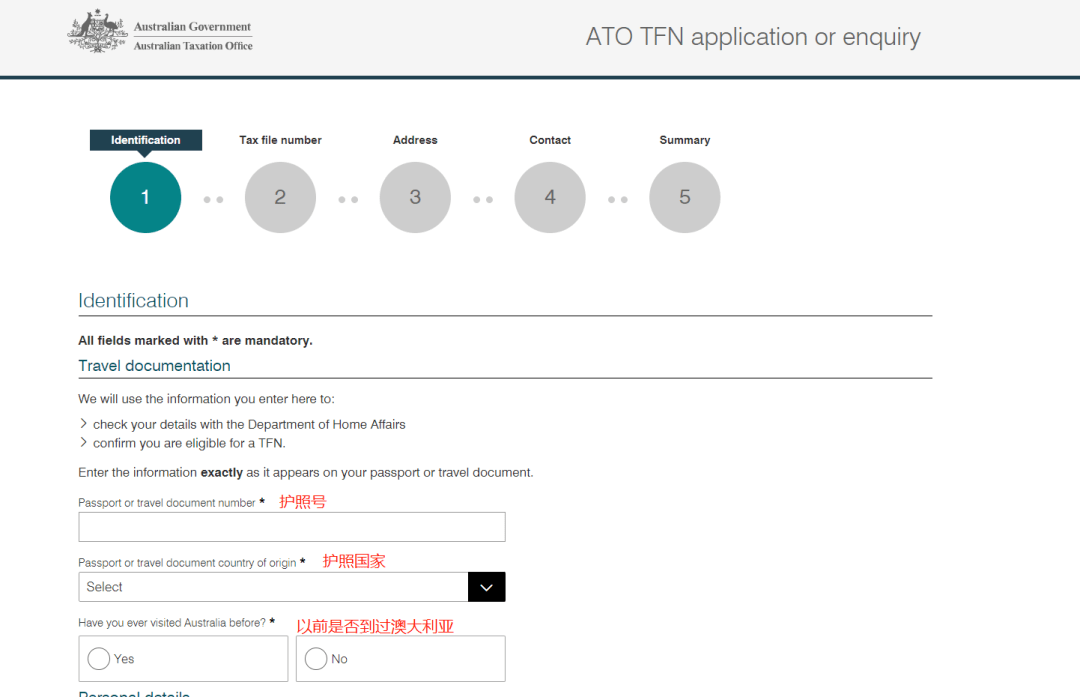

The first thing you need to fill in is your passport related information.

Fill in the content:

1. Passport number Passport number.

2. For passport country of origin, you should fill in CHINA.

3. Have you ever been to Australia? (Yes or No, generally choose NO if you have not been.)

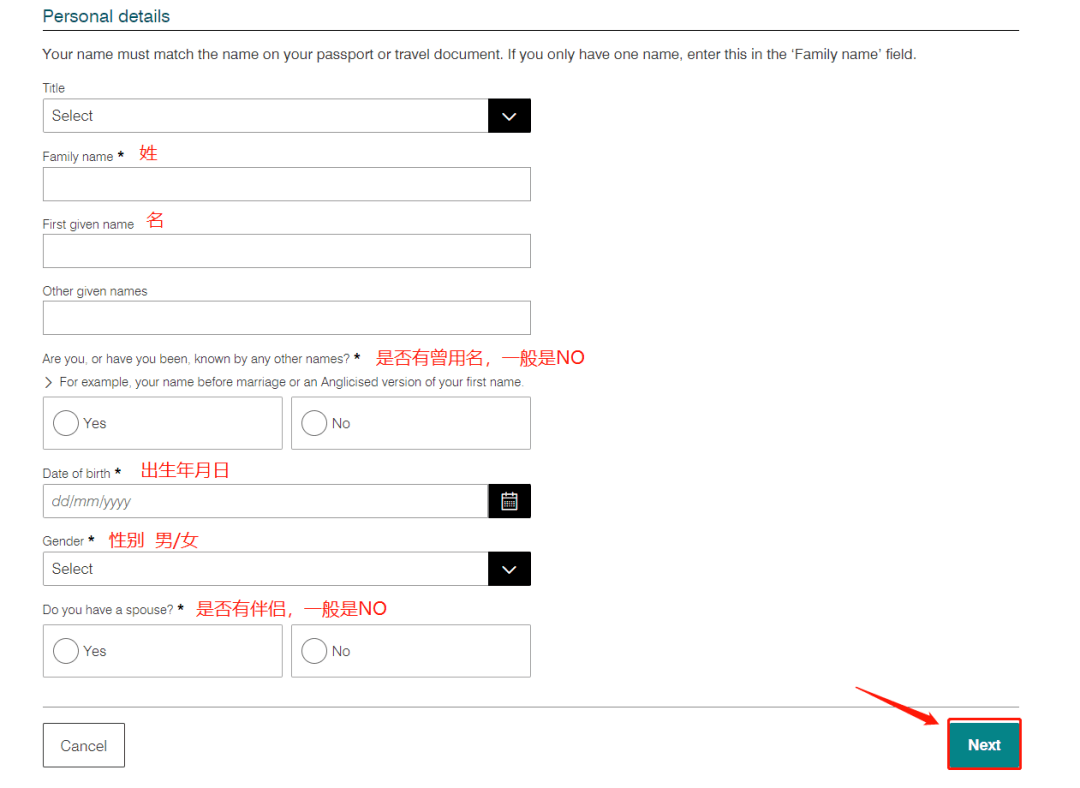

The second is content related to personal information.

After filling in the form, click Next to proceed to the next step.

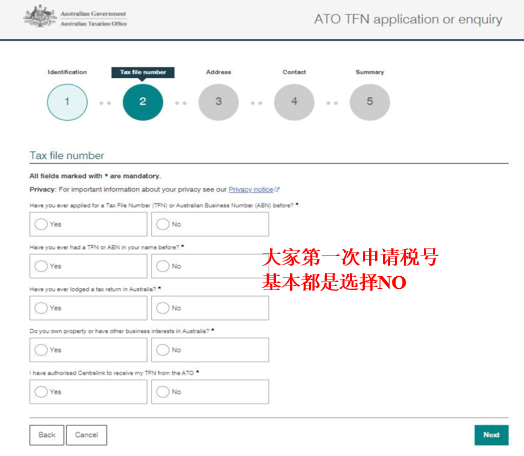

4. Basic Tax Number Questions and Answers

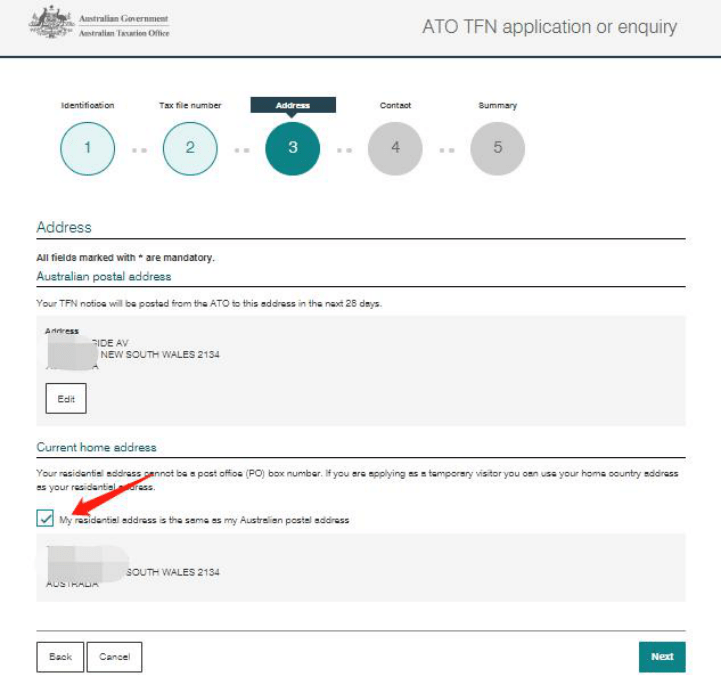

5. Fill in your home address

Please fill in your own mailing address in Australia (make sure it can receive mail) to facilitate the collection of tax number information.

Then select SAVE and check that the mailing address is the same as the home address.

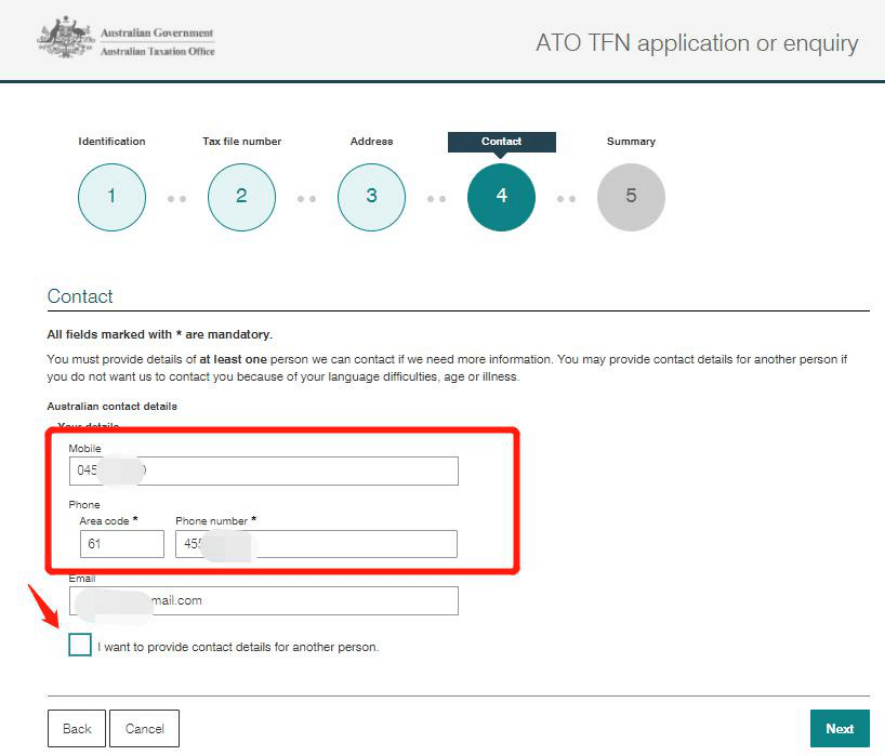

6. Fill in contact information

The contact information mainly includes phone number and email.

If you want to add other people's information, you can check the box at the bottom and add other contacts.

Usually you only need to enter your contact information.

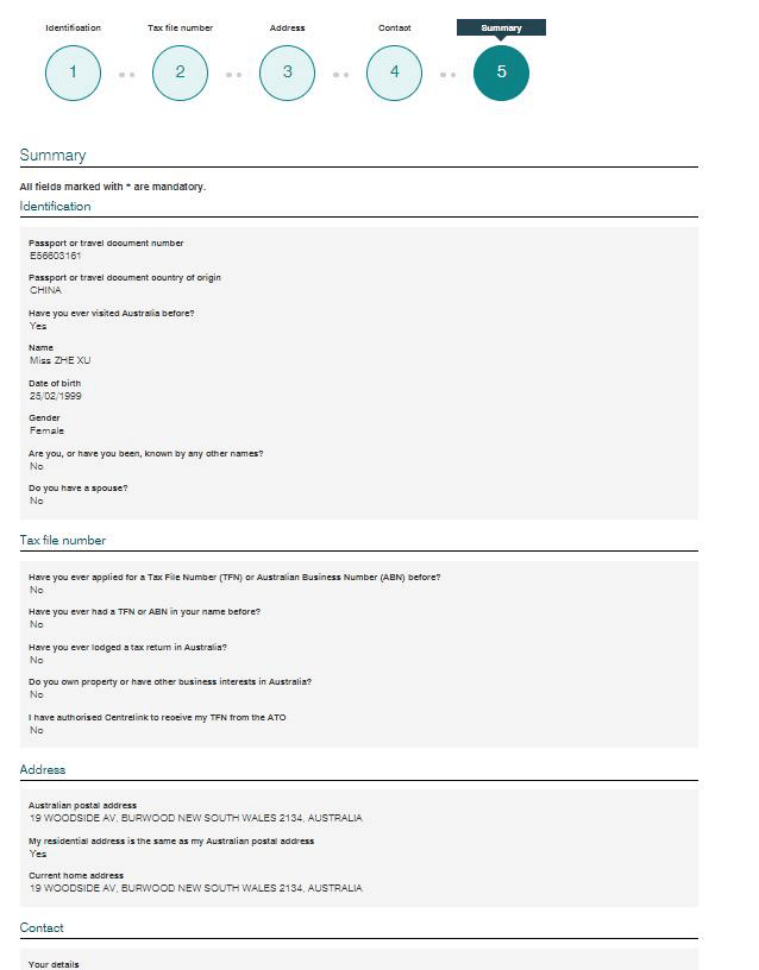

7. Information Verification

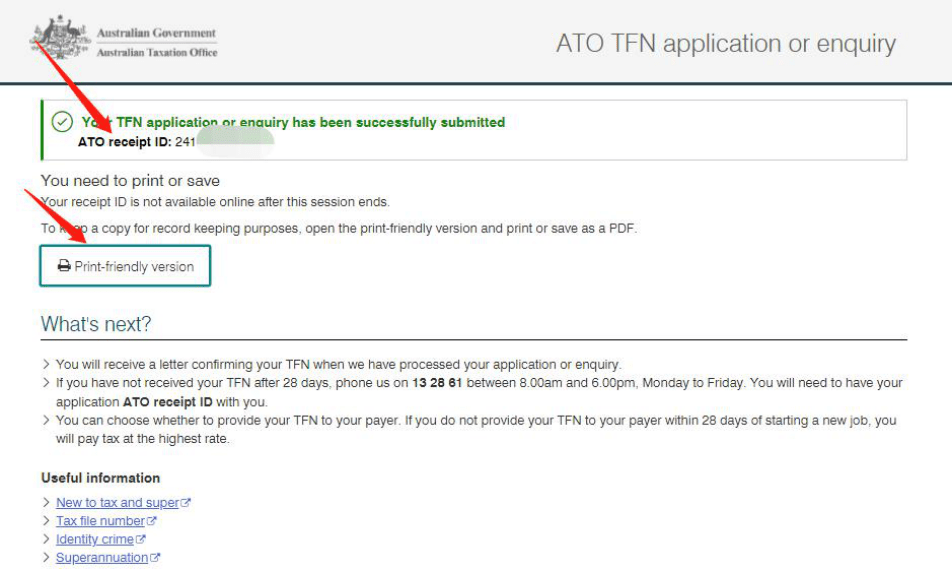

Select Submit and your ATO receipt ID will appear.

You can download it and then wait for the paper letter from ATO.

The waiting period is relatively long. The express delivery industry in Australia is extremely underdeveloped, so don't worry. It is usually 28 days, but it may be delayed due to various reasons.

If you have not received a paper letter within 28 days, you can call 132861 to contact the Australian Taxation Office for details.

转载请注明:Australian Chinese Encyclopedia AU6001.COM » How to apply for an Australian tax file number TFN (Tax File Number)