In Australia, the pension system consists of three main parts: superannuation paid by employers, age pension from the government, and pension paid voluntarily by individuals.

1. Superannuation

If you work while in Australia, you may be eligible for compulsory superannuation paid by your employer. The FY2023 superannuation is 10.5% of your ordinary income. Employers must pay super for employees who meet the following two conditions:

1) Aged 18 or above.

2) Under 18 years of age, but working more than 30 hours per week.

There are dozens of common Super companies in Australia, such as Australian Super, Hostplus Super, REST Super, etc.

2. Aged Pension

As long as you are 67 years old (from July 1, 2023), have been a PR for at least 10 years, with at least 5 years of no interruption, and your income and assets are below a certain limit, and meet the income & asset test, you can receive the pension issued by the Australian government to retirees.

3. Personal Contribution

As the name implies, you can pay this part yourself, and the pension company will help you invest. The Australian government has been committed to encouraging taxpayers to invest more of their own funds in pensions and take care of their own retirement. For example, encouraging tax regulations have been set up to encourage more taxpayers to voluntarily invest money in pensions.

4. What is the retirement age in Australia?

If you were born between July 1, 1952 and December 31, 1953, the retirement age is 65 years and 6 months;

If you were born between January 1, 1954 and June 30, 1955, the retirement age is 66;

If you were born between July 1, 1955 and December 31, 1956, it is 66 years and 6 months.

From 1 July 2023, if you were born on or after 1 January 1957, the Age Pension entitlement age will be 67.

If you want to check the latest Australian retirement age policy, pleaseClick here.

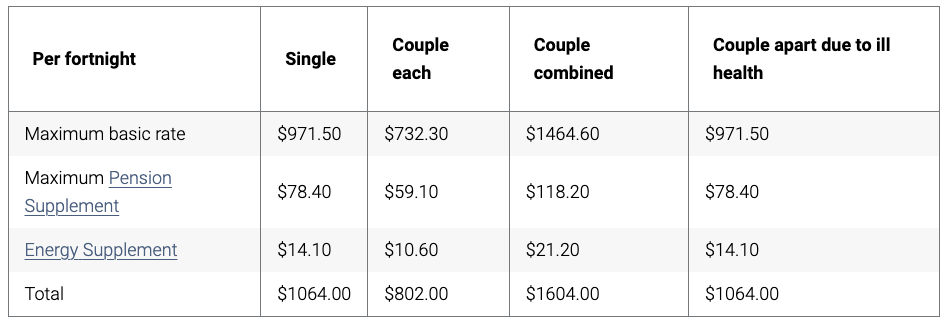

5. How much Age Pension can I get?

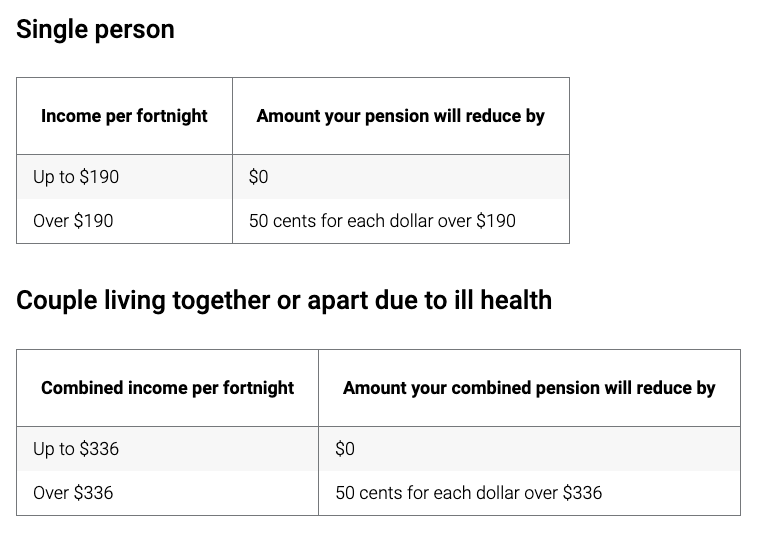

6. What is the income test for the Age Pension?

Please refer to the official website for the income test standard of the Australian pension

Is it necessary to pay superannuation?

Australian law requires employers to18 years old or olderemployees,Whether full time, part time or temporary work, should pay pensions for employees, andThe pension amount is not less than 9.5% of the pre-tax salaryThe employer's contributions will be paid to a dedicated superannuation fund management company chosen by the employee and deposited into the employee's superannuation (super fund) account at least every three months. The superannuation fund company will then manage or invest the money.

转载请注明:Australian Chinese Encyclopedia AU6001.COM » Australian pension, do you know about Australia's pension system?